Adapting to New Credit Scoring Models With Brians club

Introduction to Brians club Credit Scoring Models

In today’s fast-paced financial landscape, credit scores play a crucial role in determining your borrowing potential. As new scoring models emerge, understanding and adapting to these changes becomes essential for consumers.

Enter Brians Club—a game-changer in the world of credit scoring that offers innovative solutions tailored to help individuals navigate this evolving terrain. Whether you’re looking to improve your credit score or simply gain insights into how these new models work, Briansclub.bz is here to guide you every step of the way.

Let’s dive deeper into why Brians Club matters and how it can empower you on your financial journey.

Why Brians club Credit Scores Matter

Brians club credit scores play a crucial role in the financial landscape. They serve as a key indicator of an individual’s creditworthiness, influencing lending decisions.

Lenders use these scores to assess risk when approving loans or extending credit lines. A solid Brians club score can open doors to better interest rates and favorable terms.

Moreover, understanding your Brians club score empowers you to take control of your financial future. With this knowledge, individuals can make informed decisions about borrowing and spending.

The evolving nature of these scores reflects changes in consumer behavior and market conditions. Staying updated on your Brians club score helps you navigate these shifts effectively.

In today’s competitive environment, being aware of how your credit is perceived can significantly impact your opportunities for growth and success.

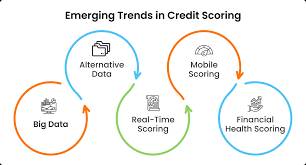

Changes in Brians club Credit Scoring Models

The landscape of credit scoring is evolving, and Brians club is at the forefront of this change. New algorithms are being introduced that focus on a broader range of financial behaviors. This shift moves beyond traditional factors like payment history.

With these updated models, aspects such as utility payments and rent history gain prominence. These changes aim to paint a more accurate picture of a borrower’s creditworthiness.

Brians club embraces these advancements by integrating alternative data sources into their scoring process. This provides deeper insights into individual financial habits.

Moreover, the emphasis on responsible borrowing encourages users to manage their finances more effectively. As members adapt to this new model, they can expect fairer assessments that reflect their true financial status better than ever before.

The Impact on Borrowers

Changes in credit scoring models can significantly impact borrowers. Many individuals may find their scores fluctuating, leading to confusion and anxiety.

For those with thin credit files or limited borrowing history, the adjustments could mean more difficulty securing loans. Lenders might adopt stricter criteria based on new metrics, leaving some ineligible for favorable rates.

On the other hand, borrowers who have managed their finances well might see an improvement. Increased transparency in evaluation processes can reward responsible financial behavior.

As these models evolve, education becomes crucial. Borrowers need to understand how these changes affect them personally and financially.

Staying informed about one’s credit score will empower consumers to make better decisions regarding loans and financial products. In this shifting landscape, adaptation is key for all involved parties.

Introducing Brians Club: A Solution for Adapting to New Credit Scoring Models

Brians Club offers an innovative approach to navigating the complexities of new credit scoring models. As these systems evolve, understanding how they impact financial decisions is crucial. This platform stands out as a valuable resource for individuals looking to adapt effectively.

Members gain insights into their credit scores and personalized strategies tailored to current scoring trends. The community fosters discussions on best practices and shares tips that can empower users in managing their credit health.

By joining Brians Club, members access exclusive tools designed to interpret shifts in credit scoring. These resources simplify processes that may otherwise feel overwhelming, ensuring borrowers remain informed and confident when applying for loans or making significant purchases.

This supportive environment encourages proactive management of one’s financial future, equipping members with knowledge essential for success in a changing landscape.

Benefits of Joining Brians Club

Joining BriansClub opens the door to a world of financial opportunity. Members gain access to exclusive credit resources that can help them navigate new scoring models with ease.

The platform offers personalized guidance tailored to individual credit situations. This means you’re not just another number; your unique circumstances are acknowledged and addressed.

Networking is another key advantage. By connecting with like-minded individuals, members share experiences and insights that promote financial literacy and empowerment.

Additionally, Brians Club provides tools for monitoring credit health. Staying informed about your score has never been easier, allowing proactive management of finances.

With continuous education on evolving scoring models, members remain ahead in this dynamic landscape. Adapting becomes effortless as you learn the ins and outs from industry experts dedicated to your success.

Brians club Testimonials from Satisfied Members

Members of Brians club have shared their experiences, showcasing the transformative power of adapting to new credit scoring models. One member recounted overcoming past challenges after joining, stating that understanding how these scores are calculated put them in control.

Another testimonial highlighted the community aspect of Brians club. Many find comfort in connecting with others facing similar hurdles. The support network has helped members navigate complex financial landscapes together.

A third member expressed gratitude for the resources provided by Brians club. They noted that educational materials and workshops were instrumental in improving their credit score significantly within months.

These stories reflect a growing sense of empowerment among members as they successfully adapt to changing credit environments. Each voice adds to a collective narrative centered around growth and resilience within the realm of personal finance.

Conclusion and Future Outlook for Brians club Credit Scores

As the landscape of credit scoring continues to evolve, Brians club emerges as a pivotal player. The adaptation to new credit scoring models can seem daunting. However, with resources and support tailored specifically for members, navigating these changes becomes manageable.

The future looks promising for those who engage with Brians club. With continuous updates on scoring methodologies and personalized guidance, members can stay ahead of the curve. By prioritizing financial literacy and embracing innovative strategies, individuals will not only understand their scores better but also improve them effectively.

Brians club is more than just a resource; it’s an empowering community that fosters growth and resilience in financial matters. As we move forward in this dynamic environment, being part of such a network could prove invaluable for both current and aspiring borrowers alike. Embracing these changes might just be the key to unlocking greater financial opportunities down the road.